Fintech Innovation

Interactive Banking Technology

Transform your banking services by introducing faytech’s state-of-the-art Interactive Banking Technology to your customers. Reach out to us today to position your institution at the forefront of banking innovation.

Banking Innovation

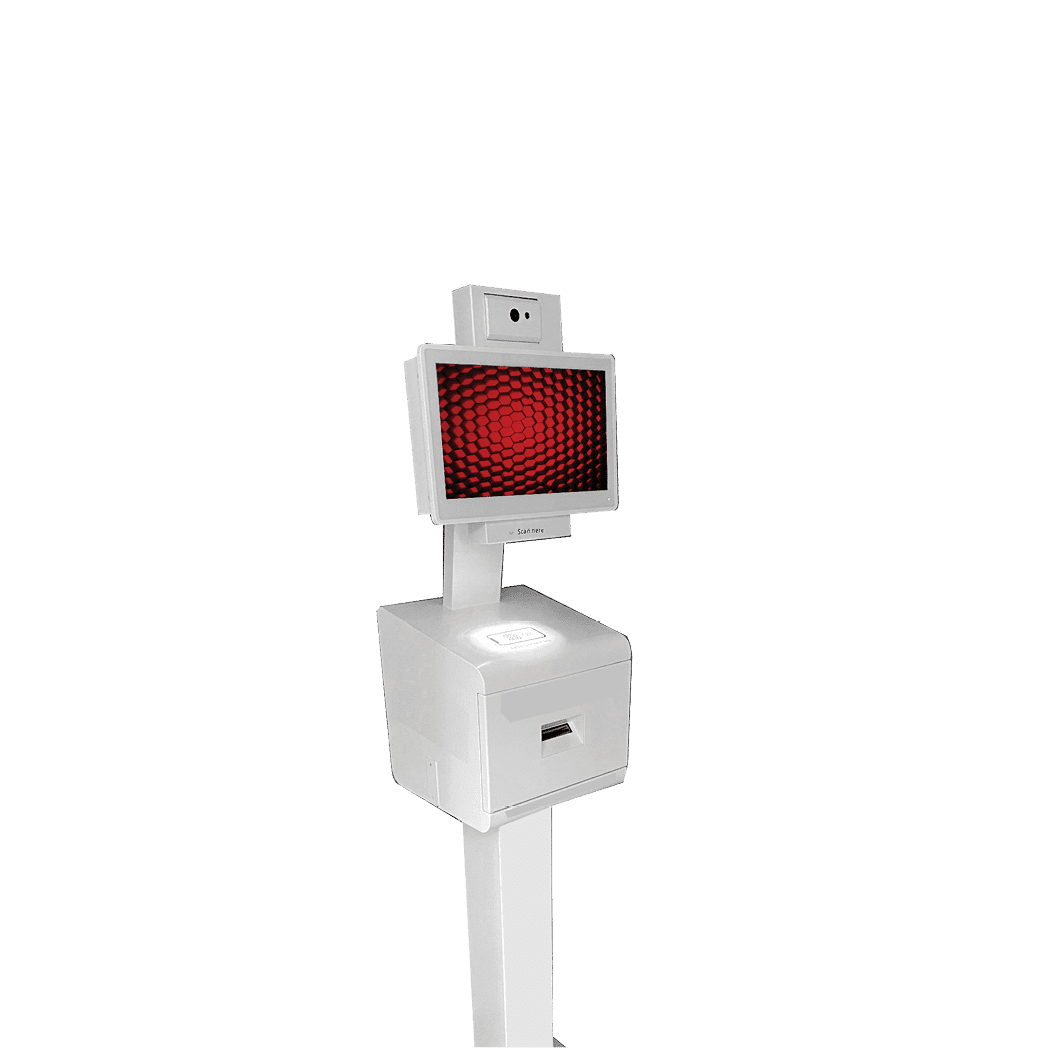

Custom Interactive Kiosks for Banking Applications

Moreover, faytech’s commitment to security and reliability is evident in these interactive kiosks. With a robust build, these machines can handle high-volume transactions while offering the necessary protections against potential security breaches. As banks continually strive to enhance customer experience and streamline in-branch operations, faytech’s Custom Interactive Kiosks emerge as an indispensable asset, ensuring that financial institutions remain cutting-edge in an ever-evolving industry.

Academic Solutions

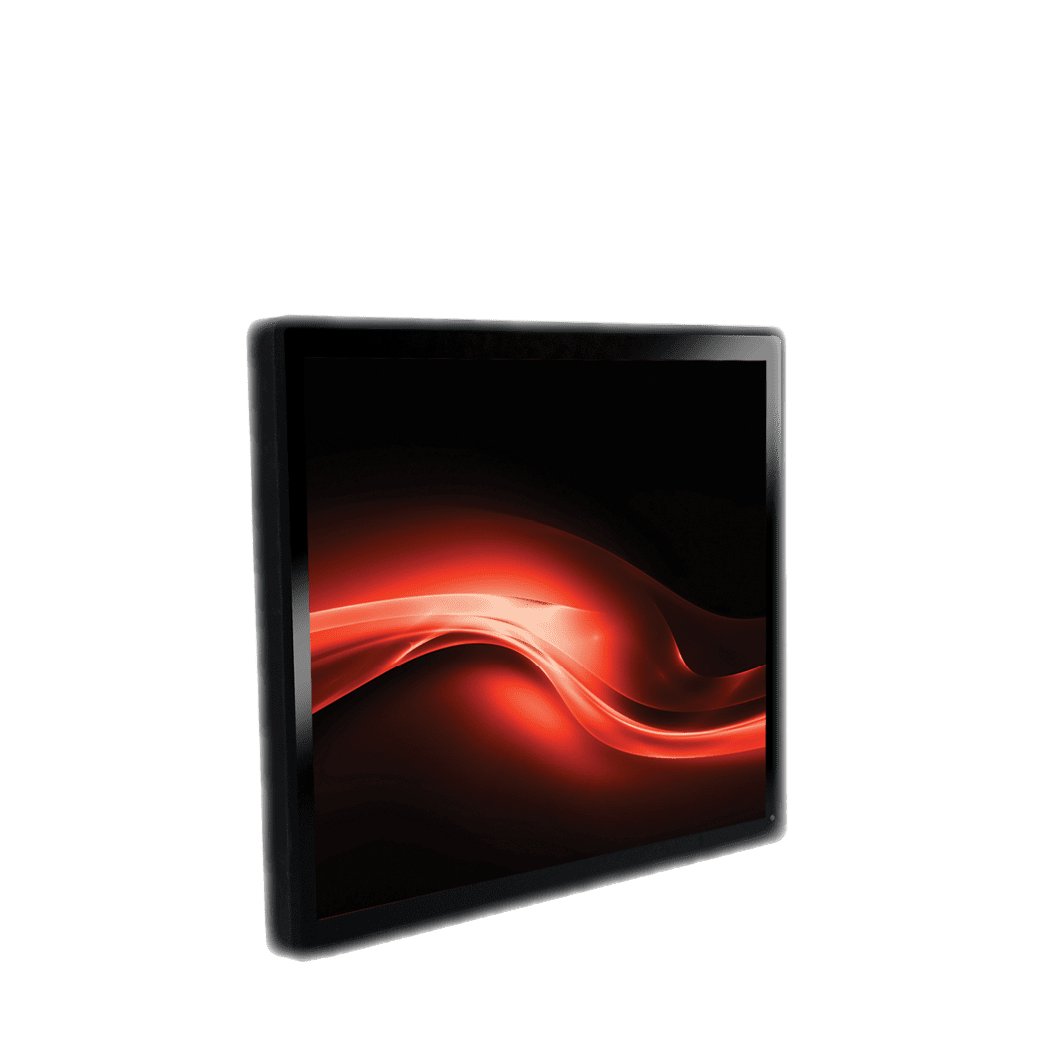

Touch

Screens

for Banking

By integrating faytech’s touchscreens into your banking institution, you can improve the customer service experience, cater to diverse banking needs, and promote efficient transaction processing. Discover how faytech’s Interactive Banking Technology can revolutionize your banking environment—download our comprehensive PDF guide now to learn more.

The Clear-Bond Advantage

faytech is the #1 provider of large format optical bonding services globally, and has its own proprietary optical bonding formula, CLEAR-BOND. CLEAR-BOND uses a silicone-based liquid adhesive that has been specifically created to provide the best optical bonding performance on the market, even in the most extreme environment

Improved Readability

Optical bonding can significantly enhance the visibility of digital signage displays by reducing the amount of reflection and glare.

Increased Touch Accuracy

Enhanced Durability

Optical bonding can make the display more resistant to physical impact, scratches, and other types of damage, increasing the longevity of the device.

Better Weather Resistance

Improved Image Quality

Improved Aesthetics

Banking Revolution

SMART Solutions for Banks & Credit Unions

More Information

Fintech – Custom Interactive Banking Technology Solutions

Banking technology, including modern technologies and new technologies, has revolutionized the way financial institutions operate and interact with customers. The adoption of digital payments and advanced technologies has greatly transformed the banking industry. By leveraging modern technologies and advanced systems, banking technology has made financial services more accessible and convenient than ever before. The use of new technologies has revolutionized the lending industry, making it easier for individuals to access loans and financial assistance. From online banking platforms to mobile apps, these digital payments technologies have transformed how individuals manage their finances with financial institutions. These technologies have revolutionized the way people access financial services and contribute to their financial wellness.

With the advent of advanced technologies in banking, customers can now easily perform various financial transactions such as transferring funds, making payments for bills, and even applying for loans through applications provided by credit unions. Emerging technologies like blockchain and cryptocurrency are reshaping the landscape of digital banking, lending, and payment infrastructure for financial institutions. These advancements present both technology challenges and opportunities for technology investments.

In this blog post, we will explore the technology challenges faced by credit unions in today’s rapidly evolving technology landscape. We will delve into topics such as digital banking solutions and fintech startups driving innovation, and discuss how technology investments can contribute to improving financial wellness for credit unions.

Current Trends in Banking Technology

Artificial Intelligence (AI) Enhancing Customer Service and Automation

Artificial intelligence (AI) is revolutionizing the financial services industry by enhancing customer service and automating various processes for financial institutions. The technology challenges faced by these institutions are being addressed with the help of AI technologies. Banks are leveraging AI-powered chatbots to provide personalized banking support and assistance to customers, reducing the need for human intervention. These chatbots are a result of advancements in banking technologies, specifically in digital banking systems. These virtual assistants, powered by advanced banking technologies, can handle routine inquiries, offer personalized recommendations, and even perform basic transactions to enhance customer experiences with modern banking systems. These assistants are particularly useful for startups looking to streamline their operations and provide efficient services to their customers.

One of the key advantages of AI technologies in banking is their ability to analyze vast amounts of data quickly and accurately, enhancing customer experiences and enabling seamless payment processes for startups. By utilizing machine learning algorithms, personalized banking technologies can help banks gain valuable insights into customer behavior, identify patterns, and predict future trends in the open banking era. This is particularly relevant for startups looking to leverage these technologies. This enables startup platforms to offer tailored financial products and services that meet individual needs effectively using open banking technologies.

Furthermore, AI technologies are being used in the banking industry for fraud detection and prevention on the startup’s platform. Advanced algorithms in the banking startup’s platform can detect suspicious activities in real-time, flagging potential fraudulent transactions before they occur using advanced technologies. This not only enhances the security of startup banks but also saves them significant amounts of money by mitigating financial losses due to fraudulent activities. These technologies are crucial for startups and are the cover story for their success.

Biometric Authentication for Secure Transactions

In an era where data breaches are a constant concern, biometric authentication methods like fingerprint scanning are gaining popularity for secure banking transactions. This is especially true in the startup community, where security is a top priority. As a result, biometric authentication methods have become a cover story in the industry. By using unique physical characteristics such as fingerprints or facial recognition, banks can ensure that only authorized individuals can access their accounts or make transactions. This innovative security measure is particularly important for startups, as they often face increased risks of unauthorized access. In fact, it has become a cover story in the banking industry, as more and more institutions are adopting this technology to protect their customers’ sensitive information.

Biometric authentication offers several advantages for banks, startups, and ING. It is a secure and innovative way to verify identities, eliminating the need for traditional password-based systems. This technology is becoming increasingly popular and has been featured as a cover story in many industry publications. Firstly, it provides a higher level of security as biometric identifiers are difficult to replicate or forge. This is especially important for a startup bank like ING, which was recently featured in a cover story. Secondly, it offers convenience to bank customers who no longer need to remember complex passwords or worry about forgetting them. This is especially beneficial for startup banks looking to attract new customers. Additionally, this feature was highlighted in the cover story of a popular industry magazine.

Banks have also started exploring other biometric technologies such as voice recognition and iris scanning for enhanced security measures in the startup industry. These technologies have become a cover story in the banking sector. These startup advancements not only improve user experience but also strengthen overall data security within the banking sector, making it the perfect cover story.

Blockchain Technology Improving Security, Transparency, and Efficiency

Blockchain technology has gained traction in recent years as a startup due to its potential to enhance security, transparency, and efficiency in banking operations. This technology has been featured as a cover story in many publications, highlighting its innovative capabilities. Blockchain is a decentralized and distributed ledger that enables secure and transparent recording of transactions for banks and startups. The startup eliminates the need for intermediaries in the bank, reduces transaction costs, and enhances operational efficiency.

One key application of blockchain in the startup banking industry is in cross-border payments. Traditional international transfers through a bank can be costly, time-consuming, and prone to errors. However, with the rise of startup companies, there are now more efficient and affordable options available for transferring money internationally. However, by utilizing blockchain technology, startup banks can facilitate faster and more cost-effective cross-border transactions with increased transparency.

Blockchain technology offers improved security for both banks and startups by providing an immutable record of transactions. This reduces the risk of fraud or tampering in a startup as each transaction is verified by multiple participants within the network. The transparency provided by blockchain in a startup also helps in combating money laundering and other financial crimes.

Future of Retail Banking: Mobile, Online, and Digital-Only

The future of retail banking for startups is rapidly evolving with the advancements in technology. With the rise of smartphones and digital transformation, banking for startups has become more convenient and accessible than ever before. This section will explore the future of startup retail banking, focusing on mobile banking apps for startups, online banking for startups, and the emergence of digital-only banks for startups.

Mobile Banking Apps: A Seamless User Experience

Mobile banking apps are revolutionizing the way customers interact with their finances, especially for startup companies. These startup apps offer a seamless user experience that allows individuals to manage their accounts on-the-go. With just a few taps on their smartphones, startup users can check their balances, transfer funds between accounts, pay bills, and even deposit checks remotely.

Pros:

- Convenience is a key aspect of our startup. Users can access their accounts anytime and anywhere using their smartphones.

- Speed: Transactions can be completed quickly without having to visit a physical bank branch, making it convenient for startup businesses.

- Enhanced Security for Startups: Advanced security features such as biometric authentication provide peace of mind for startup users.

Cons:

- Limited Features: Some startup mobile banking apps may not offer all the features available in traditional brick-and-mortar banks.

- Startup Technical Issues: Connectivity problems or app glitches may hinder the user experience at times for a startup.

Online Banking: The Preferred Choice

Online banking has gained significant popularity as customers prefer the convenience it offers to startup their financial transactions. Managing finances for a startup from the comfort of one’s home or office is now a reality. Through online platforms provided by banks, startup users can perform various transactions such as transferring funds, paying bills, applying for loans, and monitoring account activity.

Pros:

- Startup Accessibility: Customers have 24/7 access to their accounts through secure online portals.

- Online banking is a time-saving solution for startup entrepreneurs, as it eliminates the need to wait in long queues at physical branches.

- Cost-effective: Many online banks offer lower fees compared to traditional banks.

Cons:

- Security Concerns: Cybersecurity threats pose risks when conducting financial transactions online.

- Technological Barriers: Some individuals may face challenges navigating online platforms, especially the elderly or those with limited digital literacy.

Digital-Only Banks: A Disruptive Force

Digital-only banks, also known as neobanks, are emerging as a disruptive force in the banking industry. These banks operate solely through digital channels, without any physical branches. They offer innovative services and personalized experiences to customers, leveraging technology to deliver a seamless banking experience.

Pros:

- Innovative Services: Digital-only banks often provide unique features such as budgeting tools and real-time spending insights.

- Lower Costs: Without the overhead costs of maintaining physical branches, these banks can offer competitive rates and lower fees.

- Accessibility: Neobanks cater to tech-savvy customers who prefer managing their finances through digital platforms.

Cons:

- Limited Physical Support: As there are no physical branches, customers may face challenges when they require in-person assistance.

- Trust Concerns: Some individuals may be skeptical about entrusting their money to a bank that lacks a physical presence.

Technologies Revolutionizing Retail Banking

Chatbots Transforming Customer Support

Chatbots have emerged as a game-changer in the banking industry, revolutionizing customer support. These AI-powered virtual assistants provide instant assistance to customers 24/7, enhancing their overall banking experience. With chatbots, customers no longer have to wait for extended periods or navigate complex phone menus to get their queries resolved.

- Pros:

- Instant assistance available round the clock.

- Efficiently handles repetitive and routine inquiries, freeing up human agents for more complex tasks.

- Cost-effective solution for banks, reducing the need for extensive customer support teams.

- Cons:

- Limited ability to understand complex or nuanced queries.

- Lack of emotional intelligence compared to human interactions.

Big Data Analytics Driving Personalized Offerings

The advent of big data analytics has transformed how banks understand and cater to their customers’ needs. By analyzing vast amounts of data collected from various sources, including transaction histories and online behavior, banks can gain valuable insights into customer preferences and behavior patterns. This enables them to offer personalized services and tailored recommendations.

- Pros:

- Enhanced customer experience through customized offerings.

- Improved targeting of marketing campaigns based on individual preferences.

- Ability to detect fraudulent activities by identifying unusual patterns in transactions.

- Cons:

- Privacy concerns regarding the collection and use of personal data.

- Potential risks associated with data breaches and unauthorized access.

Cloud Computing Enabling Secure Data Storage and Scalability

Cloud computing has revolutionized how banks store and manage their data. By leveraging cloud infrastructure, banks can securely store large volumes of sensitive information while benefiting from enhanced scalability. This allows them to expand their operations seamlessly without investing heavily in physical infrastructure.

- Pros:

- Cost-effective storage solution compared to maintaining physical servers.

- Improved disaster recovery capabilities with automated backups on remote servers.

- Flexibility to scale resources up or down based on demand.

- Cons:

- Concerns regarding data security and privacy in cloud environments.

- Dependence on third-party service providers for infrastructure and maintenance.

These technologies, along with others like blockchain, have significantly transformed the banking landscape. As banks continue to embrace digital innovation, customers can expect more convenient and personalized banking experiences. However, it is crucial to strike a balance between leveraging technology for efficiency and maintaining robust security measures to safeguard customer data.

Robotic Process Automation (RPA) and DevOps

RPA automates repetitive tasks such as data entry, reducing errors and improving efficiency.

Robotic Process Automation (RPA) is a technology that uses software robots or “bots” to automate repetitive tasks in banking processes. These bots can perform tasks such as data entry, document processing, and transaction handling with speed and accuracy. By taking over these mundane tasks, RPA reduces the chances of human error and frees up employees’ time to focus on more complex and value-added activities.

With RPA, banks can streamline their operations by automating processes that were previously done manually. For example, instead of manually inputting customer data into multiple systems, an RPA bot can extract the necessary information from one system and populate it across various platforms accurately. This not only saves time but also minimizes the risk of errors caused by manual data entry.

DevOps practices enable faster software development cycles, enhancing agility in adapting to changing market demands.

DevOps is a set of practices that combines software development (Dev) and IT operations (Ops) to enable faster delivery of high-quality software applications. In the context of banking technology, DevOps principles help banks respond quickly to changing market demands while ensuring compliance with regulatory requirements.

By adopting agile methodologies and automation tools, banks can accelerate their software development cycles. This means that new features or updates can be rolled out more frequently, allowing banks to stay competitive in a rapidly evolving industry. DevOps promotes collaboration between development teams and operations teams, fostering a culture of continuous improvement and innovation.

By combining RPA with DevOps principles, banks can streamline operations and deliver better customer experiences.

When RPA is integrated with DevOps practices, banks can achieve even greater operational efficiency and deliver enhanced customer experiences. Here’s how:

- Increased process automation: By leveraging both RPA and DevOps techniques, banks can automate a wide range of processes, from customer onboarding to compliance management. This automation reduces manual effort, minimizes errors, and ensures regulatory compliance.

- Seamless integration: RPA bots can be seamlessly integrated with existing banking systems through APIs (Application Programming Interfaces). This allows for smooth data exchange between different applications and enables end-to-end process automation.

- Enhanced agility: DevOps practices enable banks to quickly adapt to changing market demands by facilitating rapid software development and deployment. When combined with RPA, banks can respond swiftly to new requirements or regulations without disrupting their operations.

- Improved customer experiences: By automating repetitive tasks and streamlining processes, banks can provide faster and more accurate services to their customers. This leads to improved customer satisfaction and loyalty.

Intelligent Decisioning with AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) have revolutionized the banking industry, enabling intelligent decision-making processes. By leveraging powerful algorithms, these technologies analyze vast amounts of data to make accurate predictions for risk assessment or fraud detection.

With AI-powered data analytics, banks can identify patterns and anomalies that may go unnoticed by human analysts. This allows for more effective risk management strategies, ensuring the security of customer transactions and protecting against fraudulent activities. ML models play a crucial role in optimizing loan approval processes by evaluating creditworthiness based on historical patterns. This not only streamlines operations but also enhances customer experience by providing faster loan approvals.

AI-driven chatbots are another application of this technology in banking. These chatbots use natural language processing capabilities to understand customer queries and provide personalized recommendations based on individual financial goals. They offer round-the-clock assistance, enabling customers to access information and perform basic banking tasks conveniently.

Benefits of AI and Machine Learning in Banking Technology

- Enhanced Risk Management: AI algorithms can quickly analyze large volumes of data to identify potential risks, improving overall risk management strategies.

- Improved Efficiency: ML models automate repetitive tasks such as credit scoring or fraud detection, saving time and increasing operational efficiency.

- Personalized Customer Experience: AI-driven chatbots provide tailored recommendations based on individual preferences, enhancing customer satisfaction.

- Fraud Detection: ML algorithms can detect suspicious patterns or behaviors that indicate fraudulent activities, helping banks prevent financial losses.

- Streamlined Loan Approval Processes: ML models evaluate creditworthiness based on historical data, speeding up loan approval times for customers.

Challenges in Implementing AI and Machine Learning

While the benefits of AI and ML are evident, there are challenges associated with their implementation in banking technology:

- Data Management: Banks need robust data management systems to handle the vast amounts of data required for training machine learning models effectively.

- Insider Intelligence: Banks must ensure that their AI systems are protected from insider threats, as malicious insiders can exploit vulnerabilities in the technology.

- Ethical Considerations: The use of AI and ML raises ethical concerns regarding data privacy, bias, and transparency. Banks need to address these issues to maintain customer trust.

- Skill Gap: Implementing AI and ML requires skilled professionals who understand both banking operations and advanced technologies. Bridging this skill gap is essential.

The Impact of Banking Technology

Increased Accessibility to Financial Services

Banking technology has revolutionized the way people access financial services, particularly for those who were previously underserved. With the advent of online banking and mobile applications, individuals can now conveniently manage their finances anytime, anywhere. This increased accessibility has brought banking services closer to people’s fingertips, eliminating the need for physical visits to brick-and-mortar branches.

Improved Efficiency and Reduced Costs

One of the significant benefits that banking technology offers is enhanced efficiency and reduced costs for banks. Automation and digitization have streamlined various processes, such as account opening, transaction processing, and loan approvals. By leveraging technology, banks can handle a vast amount of transactions quickly and accurately. This not only saves time but also reduces operational expenses.

Data Security and Privacy Concerns

As banking institutions increasingly rely on technology, concerns about data security and privacy have become more prominent. With vast amounts of sensitive customer information stored in digital systems, it becomes crucial to ensure robust cybersecurity measures are in place. Banks must invest in advanced security protocols to safeguard customer data from potential breaches or unauthorized access.

Competitive Advantage through Technological Innovation

Embracing banking technology provides institutions with a competitive advantage in today’s fast-paced industry landscape. Banks that leverage cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and big data analytics gain valuable insights into customer behavior patterns and preferences. These insights enable them to tailor personalized solutions for their customers, enhancing overall satisfaction and loyalty.

Compliance with Regulatory Requirements

The implementation of banking technology helps institutions stay compliant with regulatory requirements more efficiently. Automated systems enable banks to monitor transactions effectively for suspicious activities or potential money laundering attempts. Digital records make it easier for auditors to review compliance procedures thoroughly.

Bank Digital Signage Solutions

Digital signage in banks has revolutionized the way information is communicated to customers. With real-time updates on products, services, and promotions, it ensures that customers are well-informed about the latest offerings. This section will explore the benefits of digital signage in banks and how it enhances customer engagement.

Real-Time Information

One of the key advantages of digital signage in banks is its ability to provide real-time information. Gone are the days when customers had to rely on static posters or brochures for product details. Now, with dynamic digital displays, banks can instantly update their content to reflect changes in interest rates, new loan options, or exclusive promotions.

Personalized Content

Digital signage also enables banks to deliver personalized content based on customer demographics or preferences. By leveraging data analytics and customer insights, banks can tailor their messaging to specific target audiences. For example, a young professional might be shown advertisements for student loans or investment opportunities, while an elderly customer may receive information about retirement planning services.

Interactive Self-Service Options

Interactive digital signage takes customer engagement a step further by allowing users to access self-service options directly from the display screen. Customers can perform tasks such as checking account balances, making transfers, or scheduling appointments without having to wait in line at a teller counter. This convenience not only saves time but also empowers customers by giving them control over their banking experience.

Enhanced Customer Experience

By incorporating digital signage into their branches, banks create a more engaging and immersive environment for customers. The vibrant displays capture attention and create a modern ambiance that aligns with today’s tech-savvy consumers. Moreover, interactive elements like touch screens or QR codes enable customers to interact with the content actively and explore additional information at their own pace.

Cost-Effective Solution

Implementing digital signage solutions can be cost-effective for banks in the long run. While there may be an initial investment in hardware and software, the ability to update content remotely eliminates the need for printing and distributing physical materials. Banks can save on printing costs while also reducing their environmental footprint.

Improved Communication

Digital signage facilitates effective communication between banks and their customers. Important announcements, such as changes in branch hours or temporary closures, can be quickly disseminated through digital displays. This ensures that customers are always informed about any disruptions or updates that may affect their banking experience.

Interactive Banking Kiosks

Banking technology has revolutionized the way customers interact with their banks. One such innovation is the introduction of interactive banking kiosks, which provide a convenient and efficient self-service option for various transactions. These kiosks have become increasingly popular among customers due to their ease of use and time-saving benefits.

Enable Various Transactions

Interactive banking kiosks allow customers to perform a wide range of transactions without the need for human assistance. From cash deposits to bill payments, these kiosks offer a one-stop solution for all banking needs. Customers can easily deposit cash into their accounts or pay bills using these user-friendly touch screen interfaces.

Reduce Wait Times

One significant advantage of interactive banking kiosks is that they help reduce wait times at bank branches. Instead of standing in long queues, customers can simply walk up to a kiosk and complete their transactions quickly and efficiently. This not only saves time but also enhances customer satisfaction by providing a seamless experience.

User-Friendly Interfaces

The interactive touch screens on these banking kiosks are designed with user-friendliness in mind. The interfaces are intuitive and easy to navigate, ensuring that even non-tech-savvy individuals can utilize them without any hassle. Customers can access their accounts, view transaction histories, transfer funds, and perform other actions effortlessly through these interfaces.

Enhanced Security Measures

To ensure the safety of customer data and transactions, interactive banking kiosks incorporate advanced security measures. Biometric authentication methods such as fingerprint scanning or facial recognition add an extra layer of security to protect sensitive information. This helps build trust among customers who value secure banking experiences.

Improved Customer Experiences

By offering self-service options through interactive banking kiosks, financial institutions can enhance customer experiences significantly. These kiosks provide flexibility by allowing customers to conduct transactions at their convenience rather than being restricted by traditional branch hours. Moreover, the streamlined and efficient nature of these kiosks contributes to overall customer satisfaction.

Integration with Mobile Banking and Open Banking

Interactive banking kiosks can be seamlessly integrated with mobile banking and open banking platforms. This integration allows customers to have a unified experience across different channels, providing them with greater convenience and flexibility. Customers can initiate transactions on their mobile devices and complete them at the nearest interactive banking kiosk, creating a seamless omnichannel experience.

Custom Touch Screen Technology for Banks

Custom touch screen solutions have revolutionized the banking industry by allowing banks to create unique user experiences tailored to their brand identity. With the integration of touch screens into ATMs, customers can now complete transactions intuitively and efficiently, enhancing their overall banking experience.

Enhanced Customer Experience

One of the major advantages of custom touch screen technology in banking is its ability to provide an enhanced customer experience. By incorporating intuitive interfaces and user-friendly designs, touch screens make it easier for customers to navigate through various banking services. Whether it’s depositing checks, transferring funds, or checking account balances, customers can perform these tasks seamlessly with just a few taps on the screen.

Tailored Solutions for Specific Needs

Another benefit of custom touch screens is that they allow banks to cater to specific customer needs. These solutions can be personalized according to individual preferences and requirements. For instance, some customers may prefer larger fonts or audio assistance for visually impaired individuals. With custom touch screen technology, banks can easily accommodate these specific needs and ensure inclusivity for all their customers.

Self-Service Interactions

Touch screens enable self-service interactions in the banking sector while maintaining a high level of security. Customers are empowered to carry out transactions independently without relying on bank staff. This not only reduces waiting times but also gives customers more control over their financial activities.

Secure Transactions

Security is a top priority in the banking industry, and custom touch screen technology ensures that customer data remains protected throughout every transaction. Advanced encryption techniques and secure protocols safeguard sensitive information from unauthorized access or fraudulent activities.

Streamlined Operations

By implementing touch screen technology in ATMs and other self-service kiosks, banks can streamline their operations and reduce staffing costs. With automated processes facilitated by touch screens, routine tasks such as cash withdrawals or balance inquiries can be completed quickly without the need for human intervention.

Conclusion: The Impact of Banking Technology with Interactive Touch Screens

In conclusion, the rapid advancements in banking technology have revolutionized the way customers interact with their banks. With the rise of interactive touch screens, banks are able to provide a more engaging and personalized experience to their customers. These touch screens offer a wide range of functionalities, from digital signage solutions to interactive banking kiosks, all aimed at enhancing customer satisfaction and convenience.

As we look towards the future of retail banking, it is evident that mobile, online, and digital-only platforms will play a crucial role. Technologies such as robotic process automation (RPA) and DevOps enable banks to streamline their operations and improve efficiency. Moreover, intelligent decisioning powered by AI and machine learning empowers banks to make data-driven decisions that benefit both the institution and its customers.

To stay competitive in this rapidly evolving landscape, it is essential for banks to embrace these technological advancements. By implementing custom touch screen technology tailored specifically for banking needs, institutions can enhance customer engagement while optimizing operational processes. It is clear that banking technology with interactive touch screens has a profound impact on the industry by transforming traditional banking into a more efficient and customer-centric experience.

FAQs

Q1: How do interactive touch screens benefit banks?

Interactive touch screens provide several benefits for banks. They enhance customer engagement by offering personalized experiences through digital signage solutions and interactive kiosks. They also optimize operational processes through technologies like robotic process automation (RPA) and DevOps.

Q2: Can AI be used in retail banking?

Yes, AI plays a significant role in retail banking. It enables intelligent decision-making based on data analysis and machine learning algorithms. This helps banks provide personalized recommendations, detect fraud patterns, automate processes, and improve overall efficiency.

Q3: What are some current trends in banking technology?

Current trends in banking technology include mobile banking apps, biometric authentication methods like fingerprint scanning, chatbots for customer support, and blockchain technology for secure transactions.

Q4: How do touch screens improve customer experience in banks?

Touch screens provide a more interactive and intuitive way for customers to navigate banking services. They offer self-service options, personalized recommendations, and easy access to information, enhancing convenience and satisfaction.

Q5: Are digital-only banks the future of retail banking?

Digital-only banks are gaining popularity as they offer convenient and cost-effective banking solutions. While traditional brick-and-mortar branches will still have their place, digital-only banks are likely to play a significant role in the future of retail banking.